June 20, 2023

YOLO Is More Than Fun – It’s a Financial Risk You Can’t Afford

As a Gen-Z, it’s exciting to finally step into the adult world – your first job, your first salary, and the first taste of financial freedom. This newfound freedom often comes with a popular mantra, “YOLO” (You Only Live Once). Embraced by many, YOLO has become synonymous with living life to the fullest, seizing the day, and not worrying too much about tomorrow. But when it comes to your finances, YOLO could be the worst advice you follow.

Why, you ask? The answer lies in the repercussions of adopting the YOLO approach to money matters.

1. YOLO’s Cost: Robbing You of Time

The primary issue with the YOLO mindset is that it encourages delaying financial planning. After all, if you’re living for today, why bother planning for tomorrow? This delay could potentially rob you of your most significant asset – time. When it comes to investing and growing wealth, time is your biggest ally.

2. “YOLO” Away The Power of Compounding

The YOLO approach makes you lose out on time, which subsequently leads to missing the magic of compound interest – the most powerful financial phenomenon. Albert Einstein once called compound interest the eighth wonder of the world, and for a good reason. The earlier you start investing, the more time your money has to grow exponentially.

Compound interest is the eight wonder of the world. – Albert Einstein

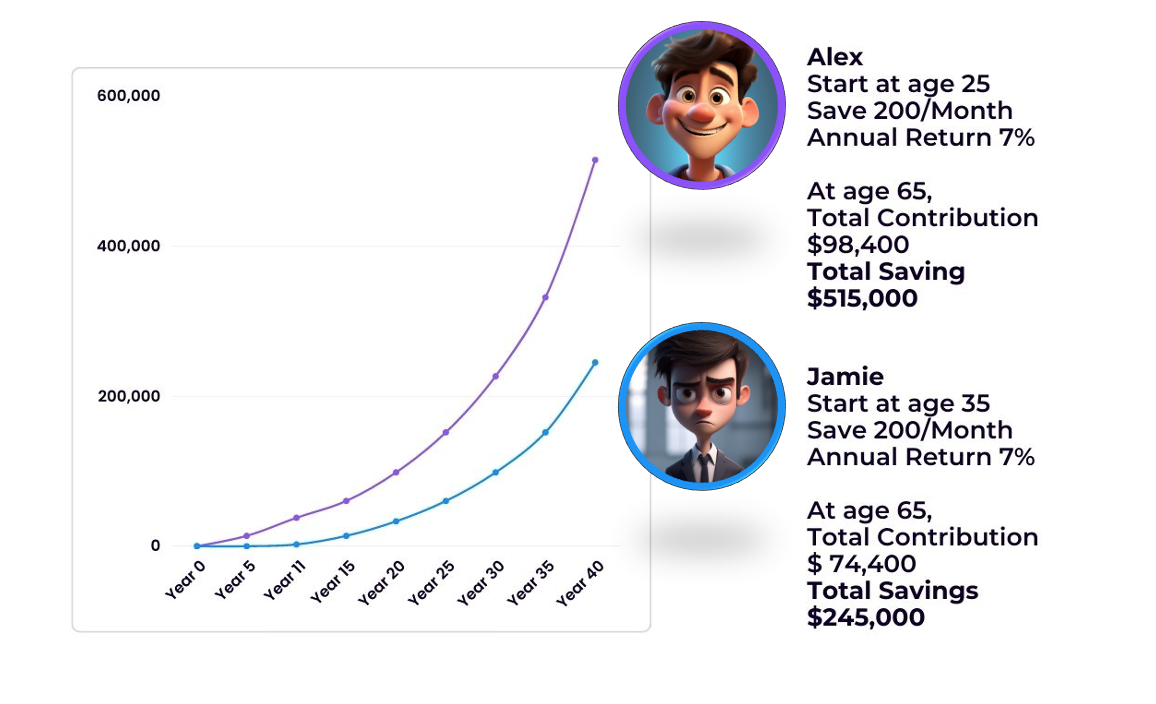

Consider two individuals, Alex and Jamie. Both decide to invest $200 a month, but they start at different ages.

Alex, mindful of the potential of compound interest, starts investing at the age of 25. He continues to invest the same amount each month until he turns 65. With an annual return rate of 7%, by the time Alex is 65, his investment would have grown to around $515,000.

On the other hand, Jamie, influenced by the YOLO mindset, decides to start investing at the age of 35, a decade later than Alex. Investing the same amount monthly and getting the same rate of return, by 65, Jamie’s investment would amount to around $245,000.

Despite investing the same amount each month and earning the same rate of return, Alex ends up with more than double the retirement savings of Jamie. That’s the magic of starting early and the power of compound interest – time is the most crucial factor in growing your wealth. The YOLO mindset often makes you lose this precious time, leaving you significantly disadvantaged in the long run

3. Unprepared for Financial Emergencies, Ignoring Health Insurance

“Live in the moment” seems like a thrilling mantra until a sudden financial emergency strikes. Be it job loss, medical emergencies, or unexpected large expenses – if you’ve been living the YOLO lifestyle, chances are you might not be prepared for these financial hiccups.

Imagine being hit by an unexpected illness. The medical bills start to stack up, reaching into thousands. With the YOLO mentality, long-term safety nets like health insurance are often overlooked in favor of immediate pleasures. So, when sickness strikes, you’re left to handle these exorbitant costs on your own.

This financial burden can quickly spill over to your loved ones, causing a ripple effect of economic hardship. They may struggle to manage these costs while maintaining daily expenses. The YOLO approach can lead to a financial crisis affecting not only you but your family as well—a crisis that could have been averted with prudent planning

Conclusions

Although YOLO seems appealing, it’s not the smartest philosophy when it comes to managing your finances. There are alternatives out there – for instance, the FIRE (Financial Independence, Retire Early) approach. But remember, FIRE too comes with its own set of challenges and isn’t a one-size-fits-all solution.

Ready to take the first step towards better financial planning? Join us at our upcoming ‘Firestarter’ event. Here, we’ll discuss how you could potentially achieve FIRE (Financial Independence, Retire Early) by the age of 35. Click here to register for this event or receive a recording of the session

Remember, YOLO is a fun motto for adventure, but when it comes to finances, you certainly live more than once. So plan accordingly.

Are you seeking a community of individuals who share your drive for financial literacy and wealth creation? Don’t journey alone. Click here to become part of our dynamic community, where we learn, grow, and prosper together in our financial endeavors