China recently unveiled a sweeping economic stimulus package. Since the announcement, the market seems optimistic about China’s outlook. The blue-chip CSI 100 Index for Mainland China stock exchanges shot up by 15%, raising hopes for a potential rebound. Let’s find out what China’s September 2024 Stimulus means.

But the question remains: Does this signal the beginning of a true recovery for China?

In this article, we will be talking about:

- China’s September 2024 Stimulus: A breakdown of the key measures, including monetary easing, real estate support, and stock market liquidity provisions.

- The Major Economic Challenges: Focus on slowing growth, the real estate crisis, and sluggish domestic consumption affecting the Chinese economy.

- GoodWhale’s Take: Our cautious view on how the stimulus may provide temporary relief but struggles to address long-term structural issues in the economy.

China’s facing a different problem from the U.S.

While the U.S. has been cooling its economy and lowering inflation, China is taking the opposite approach, boosting economic activity through aggressive stimulus measures. Let’s dive into what’s going on in the Chinese economy, what the latest stimulus package entails, and what it means for investors.

Source: Trading Economics

What’s Going on with China’s Economy?

China’s economy is currently grappling with multiple challenges, which have collectively slowed growth. Here’s a breakdown of the key issues:

1. Slowing Economic Growth

After decades of rapid expansion, China’s growth has decelerated. Factors such as the fallout from the COVID-19 pandemic, trade tensions with the U.S., and weakening global demand for Chinese exports have hit the country hard. Once reliant on its booming manufacturing sector, China now faces reduced demand for its goods globally.

2. Real Estate Crisis

Chinese property developers, like Evergrande, borrowed heavily to fund large-scale housing projects, betting on sustained high demand. However, the market became oversaturated, causing property prices to plummet. The collapse of developers like Evergrande led to unfinished projects and a steep drop in buyer confidence.

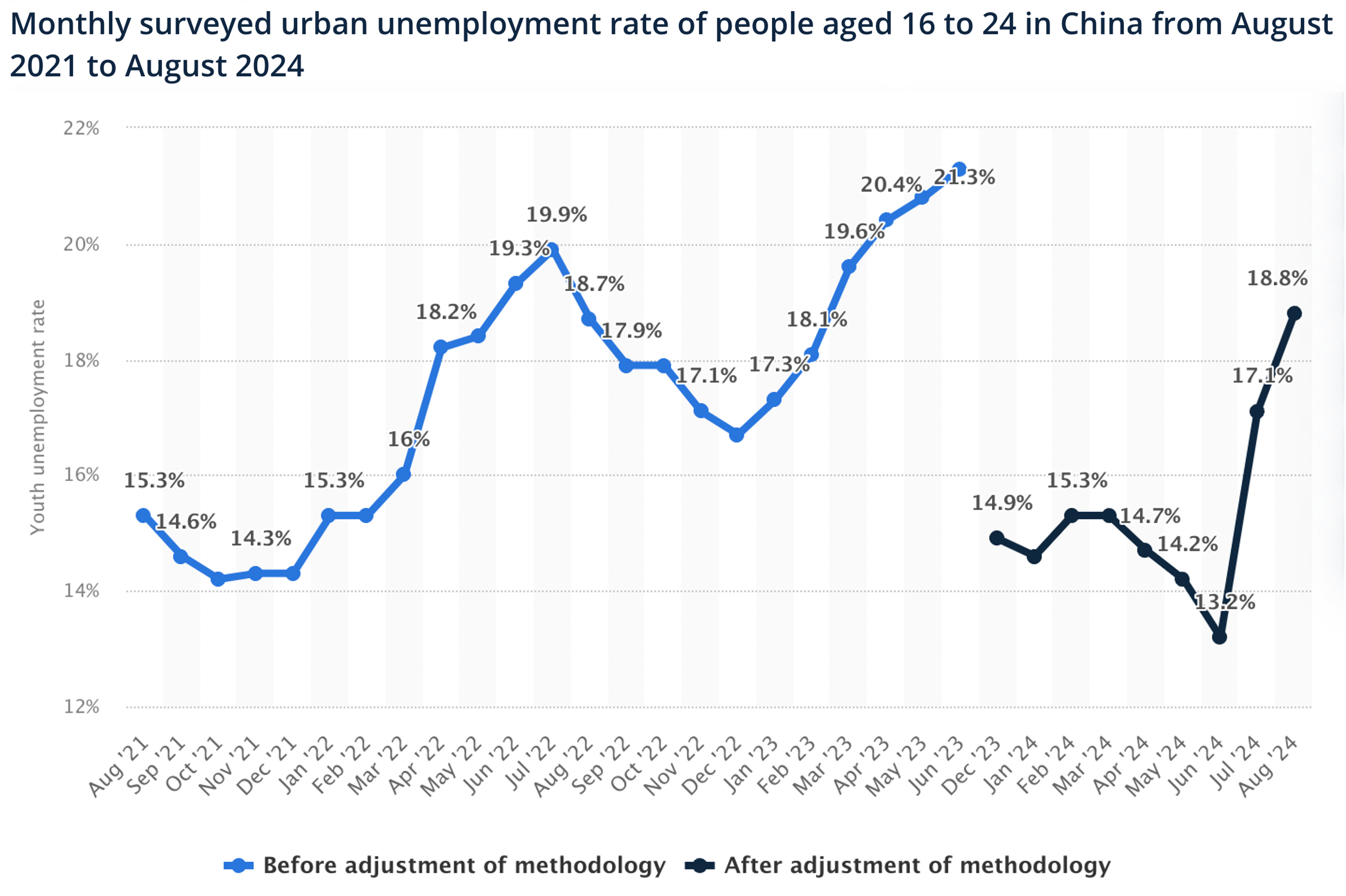

3. Youth Unemployment

Youth unemployment has surged, with recent figures showing nearly 20% of urban youth are jobless. This is partly due to slow recoveries in key industries like real estate and manufacturing, and a mismatch between available jobs and the skills of new graduates.

Source: Statista

4. Sluggish Domestic Consumption

China’s consumers are cautious about spending. Economic uncertainty, high unemployment, and stagnant income growth have reduced consumer demand for goods, services, and even homes. Government attempts to stimulate spending through tax cuts and subsidies have so far been insufficient.

5. Deflationary Pressures

China has faced deflation for consecutive quarters, which can be dangerous. While falling prices might seem beneficial, it often signals weak demand, leading businesses to cut back on production and jobs. This vicious cycle can further undermine consumer confidence.

What is the China’s September 2024 Stimulus? How Big Is It?

To combat these challenges, China’s government unveiled a significant stimulus package in September 2024, targeting three key areas:

1. Monetary Easing Measures

- 7-day reverse repo rate cut by 20bps: The rate was cut to 1.5%, exceeding market expectations for smaller, gradual reductions.

- 1-Year Medium Lending Facility (MLF) rate cut by 30bps: This is aimed at easing credit conditions and encouraging investment.

- Reserve requirement ratio (RRR) cut by 0.5%: This cut releases 1 trillion yuan into the financial system, with potential for more cuts later in the year.

2. Real Estate Market Support

- Lower mortgage rates for existing loans: The move aims to reduce financial burdens for households, potentially boosting consumption.

- Down payment ratio for second homes reduced to 15%: This is intended to stimulate property market activity, though the impact may be limited due to weak sentiment.

3. Financial Market Liquidity

- Loan prime rate and deposit rate cuts: These measures will help keep banks liquid and mitigate the impact on their margins.

- 500 billion yuan liquidity support for Chinese stocks: This injection is aimed at stabilizing equity markets, giving brokers and funds access to central bank liquidity

GoodWhale’s Take on China’s Stimulus

While China’s September 2024 stimulus package is large and comprehensive, its effectiveness in fully turning the economy around is still uncertain. The monetary easing measures are likely to stimulate credit flow and investment, particularly in tech and infrastructure sectors, but the core issue remains weak consumer confidence and sluggish demand, especially in the real estate market.

Though the lower mortgage rates and down payment reductions for second homes could stabilize housing prices, the ongoing challenges of oversupply and massive debt in the property sector make a full recovery less likely without deeper reforms. Meanwhile, the liquidity support for the stock market sends a strong signal of government backing, but this may only provide temporary relief if underlying economic challenges persist.

GoodWhale recommends adopting a cautious “monitor” approach. While there are opportunities in sectors like infrastructure, renewable energy, and financial markets, investors should be wary of overexposure to highly leveraged sectors like real estate. As always, it’s important to track how policies evolve and how markets respond over the coming months.

Stay connected with GoodWhale’s Wealth Pulse for ongoing updates and in-depth discussions on key market news. We’ll continue to filter the noise and guide you through this economic marathon. Join us every Tuesday, 8 – 9pm live to build your confidence and ease any anxiety.

[…] Deflationary Pressures: China has faced consecutive quarters of deflation, reflecting weak demand across key industries. This has negatively impacted corporate profits and wages, reducing consumer confidence and spending power(GoodWhale). […]