The Latte Factor: How Small Daily Expenses Can Hinder Your Wealth Growth

In the world of personal finance, one concept that often gets attention is “the latte factor.” Coined by financial expert David Bach, this idea highlights how seemingly insignificant daily expenses can accumulate over time, impacting your overall wealth. But what does this really mean for your financial future? Let’s dig into the latte factor and how small daily expenses can either hinder or help your journey to wealth.

Understanding the Latte Factor

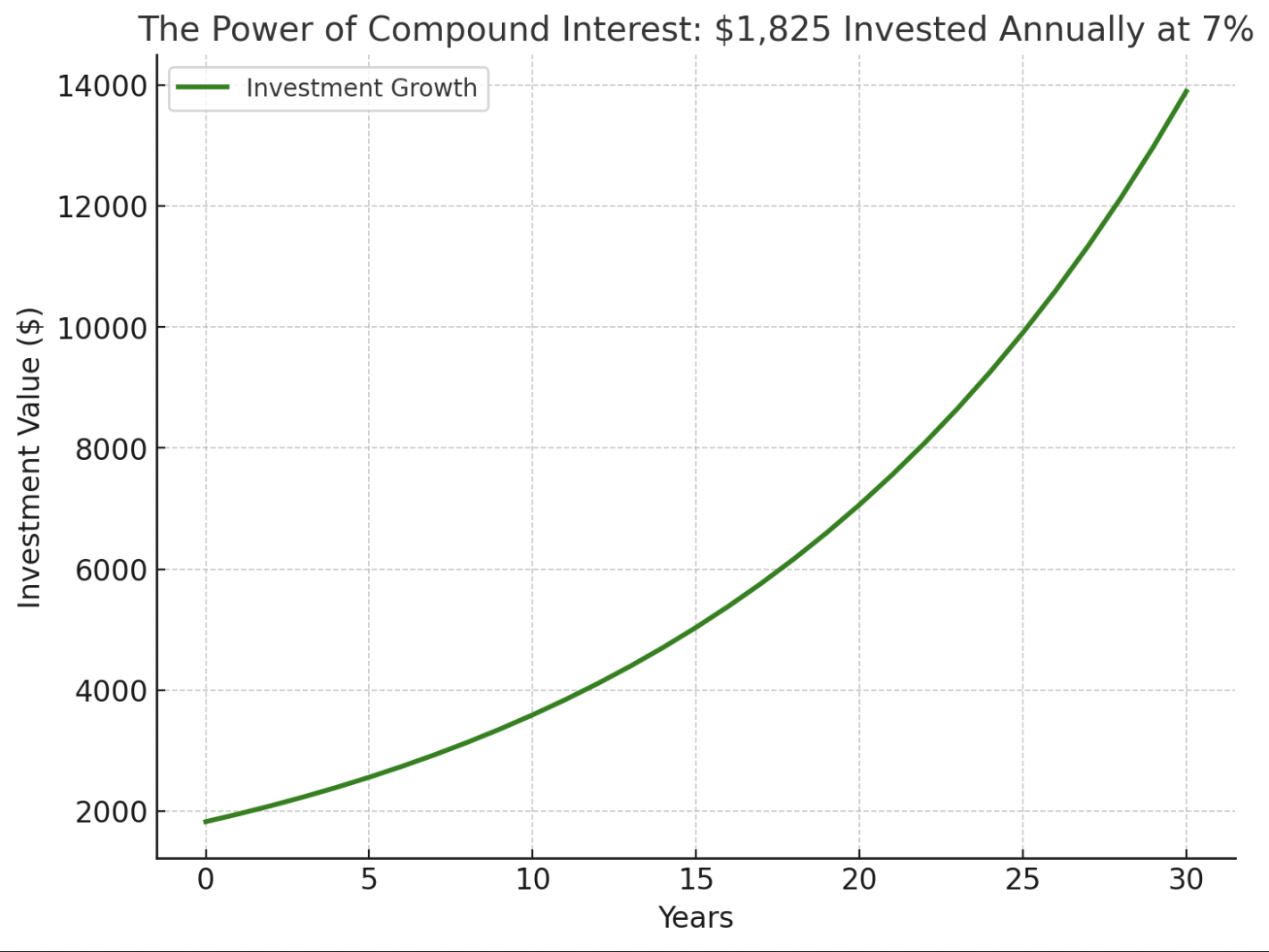

At its core, the latte factor refers to the habit of spending on small luxuries—like that daily coffee from your favorite café. While a $5 latte may seem harmless on its own, if you buy one every day, that adds up to $1,825 a year. Imagine instead investing that amount into a retirement account or a high-yield savings account. Over time, thanks to compound interest, this could lead to substantial wealth accumulation.

The Power of Compound Interest

To illustrate the impact of investing your small daily expenses, consider the concept of compound interest. When you invest your money, not only do you earn interest on your initial investment, but you also earn interest on the interest. This exponential growth can turn even modest savings into significant wealth over the years. For example, investing that yearly $1,825 latte budget at an average annual return of 7% could yield over $135,000 after 30 years. This highlights how small decisions can lead to extraordinary outcomes when given time to grow.

Recognizing Other Daily Expenses

While the latte factor specifically addresses coffee purchases, it’s important to recognize that other daily expenses can have a similar effect. Whether it’s frequent takeout meals, subscription services, or impulse buys, these costs can quickly add up. By tracking your spending habits, you can identify areas where small adjustments could be made.

Imagine reallocating those funds into an investment account. A small shift, like reducing takeout expenses by $10 a week, could translate into another $520 annually. Investing this could significantly boost your long-term wealth.

Mindful Spending: A Shift in Perspective

Awareness is the first step towards financial empowerment. Instead of viewing small expenses as justifiable treats, consider them as opportunities for investment. This shift in mindset can lead to more intentional spending. If you love your daily coffee, perhaps try brewing it at home a few days a week. The taste may still be satisfying, and you’ll save money in the process.

Building Wealth Through Strategic Investments

Investing doesn’t have to be daunting. You can start small, whether it’s through a retirement account, index funds, or even a simple savings account with good interest rates. The key is consistency and patience. By committing to set aside the money you save from cutting small daily expenses, you can create a robust investment portfolio over time.

Read: Ready to Invest? Here’s How Much You Actually Need

Conclusion

In conclusion, the latte factor serves as a powerful reminder of how small daily expenses can accumulate and impact your financial health. By being mindful of your spending and redirecting those funds into investments, you pave the way toward wealth growth and, ultimately, financial freedom. It’s not about sacrificing enjoyment; it’s about making informed choices that align with your long-term financial goals.

To enhance your journey, consider joining the GoodWhale Community. Engaging with this online investment community gives you access to a wealth of knowledge and expertise from fellow members. You’ll find individuals with diverse backgrounds and experiences in investing, ready to share insights and strategies. By actively participating in discussions, you can learn new investment techniques and stay updated on market trends and opportunities. Start today, and see how small changes can lead to significant financial rewards while connecting with a community that supports your growth!

[…] Read: The Latte Factor: How Small Daily Expenses Can Hinder Your Financial Growth […]

[…] Read: The Latte Factor: Small Costs, Big Financial Impact […]