Singapore Is the 2nd Richest Country… But Should You Care?

Every now and then, headlines proudly declare: Singapore is one of the richest countries in the world!

The latest one? Average annual earnings of about US $90,700 (around S$116,225).

It sounds impressive. But… so what?

Why These Numbers Are Not Helpful

Source: 1M65

We’ve all seen these “richest country” reports before. Looks good from the country’s point of view, but honestly, not that useful for the average person.

So what if we’re at the top?

So what if some people earn that amount?

So what if you earn less than that amount?

For many, seeing such figures can do more harm than good. It can trigger thoughts like:

“I’m earning less than the average. Am I not good enough? Am I inferior? Why is life not fair?”

But comparing your life to an arbitrary average is like comparing your home-cooked dinner to a Michelin-star meal, it doesn’t necessarily make sense, and it can ruin your appetite.

The Better Mindset: Gratitude and Control

The other night, I was doing my usual YouTube scroll, you know, half-looking for finance tips, half-procrastinating, when I landed on a video by Mr. Loo.

If you don’t know him, he’s the guy behind the “1M65” movement, which basically helps Singaporeans aim for $1 million by age 65. His style? No fluff, just straight-to-the-point money advice that actually makes sense.

In this video, he was talking about Singapore’s shiny new title as the 2nd richest country in the world. Impressive? Sure. Life-changing? Not really.

But buried beneath all the headlines and big numbers were two takeaways that hit me harder than the stats:

-

Stay grateful for what you have.

-

Expose yourself to investing early.

On a more personal level, I’d add: stop caring so much about these reports, especially the numbers.

Not earning the “average” is perfectly fine. What matters more is:

-

Keeping your spending low

-

Saving a good portion of your salary

-

Starting to invest as early as you can

Do that consistently, and you can still retire comfortably without worrying about money.

For me, the key is sufficiency, knowing what you have, knowing what you need, and allowing for a little bit of “wants” without overindulging. And never forget: money is just one part of life’s priorities.

Don’t Put All Your Eggs in One Basket

One part I especially liked from Mr. Loo’s talk was his reminder about diversification.

Even our own sovereign wealth fund doesn’t put all its money in Singapore. According to GIC’s portfolio report, a significant portion of investments are made overseas.

The lesson is simple: a country is a “basket” too. Whether you’re investing as an individual or a nation, diversification reduces risk.

Income Is Only the First Step

Here’s a simple formula I live by:

Income – Spending = Savings

Without savings, you can’t build an emergency fund, achieve near-term goals, or enjoy peace of mind even if you stop working.

Yes, income matters. But without controlling your spending, higher income just leads to higher expenses and zero progress.

The Real Game-Changer? Tracking Your Expenses

If you don’t know where your money goes each month, you’re flying blind.

Knowing your income is nice. But knowing your savings rate that’s where true financial control begins.

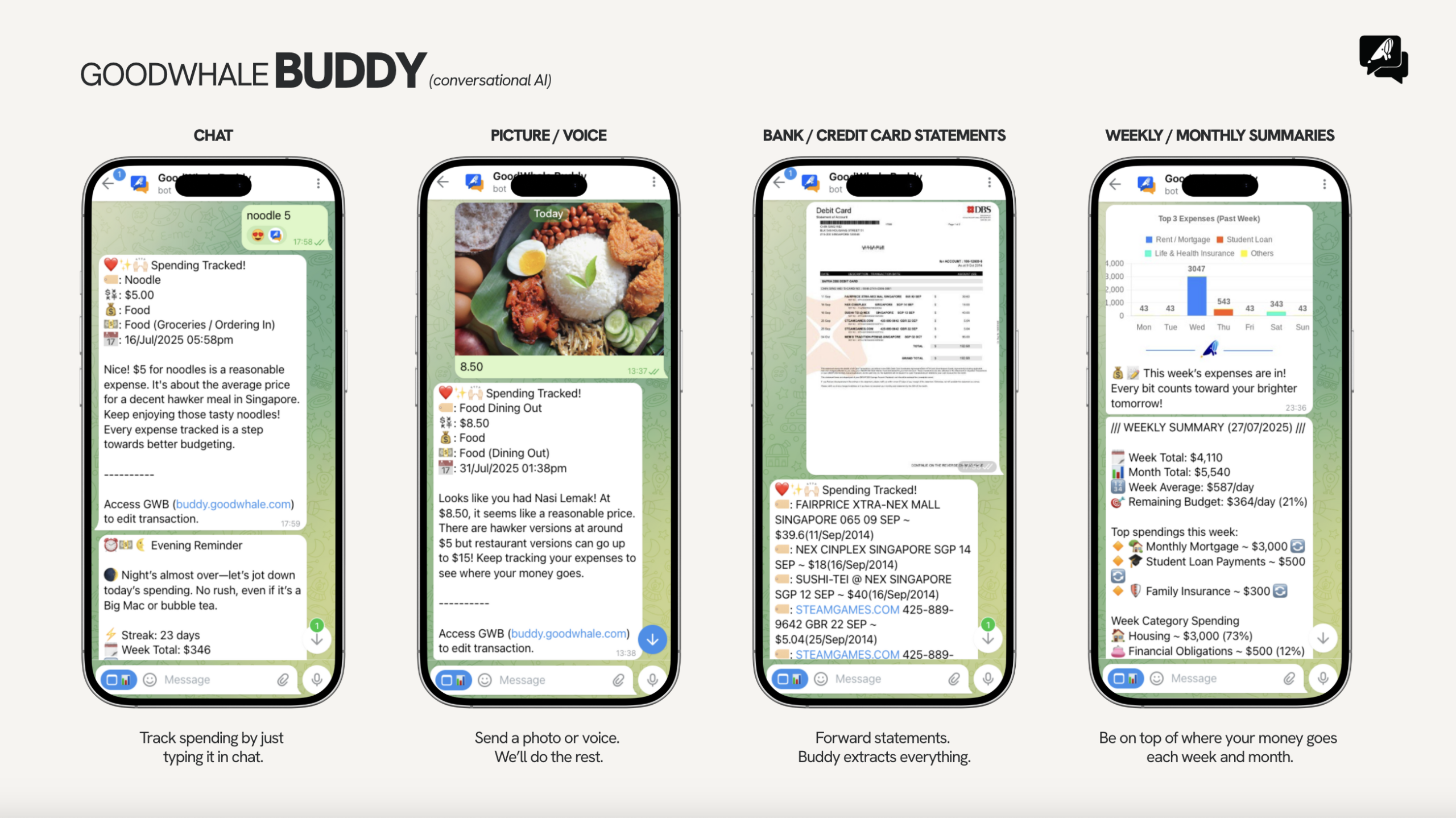

Meet GoodWhale Buddy, Your Simple Expense Tracker

That’s why we built GoodWhale Buddy. Think of it as your friendly AI money coach who makes expense tracking effortless.

You can:

-

Text it: Dinner 8.50 or Coffee 6

-

Snap a photo of your receipt

-

Send a quick voice note

-

Upload your bank statement for automated logging

No painful spreadsheets. No overcomplication. Just easy tracking to help you start and stick to the habit.

My $5

These “richest country” rankings might be interesting, but they won’t help you reach your financial goals.

Instead of comparing yourself to a national average, focus on what you can control:

-

Your spending habits

-

Your savings rate

-

Your investment strategy

And remember, there’s no better time to start than now.

So, why not take the first step today? Start tracking your expenses with GoodWhale Buddy, and build wealth on your own terms.

Leave a Reply