Whenever SEA Limited (NYSE: SE) reports results, all eyes are on Shopee. After all, it’s the giant e-commerce engine that powers most of SEA’s revenue. But in the latest SEA Limited earnings 2025, another part of the business quietly showed signs of becoming a bigger deal. Monee.

So while the headlines scream “Shopee growth,” investors who stop there could miss the bigger picture. Let’s break down what really matters from SEA’s 2025 earnings.

1. Shopee Still Steals the Spotlight

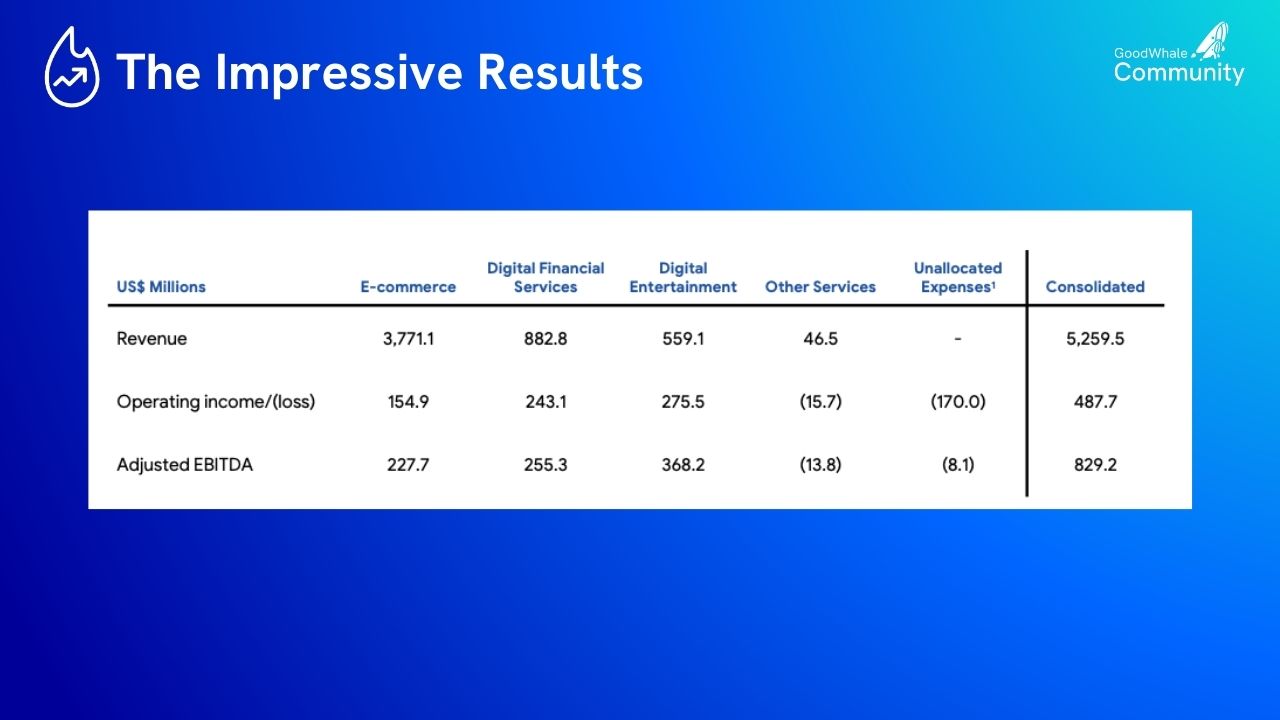

There’s no denying it: Shopee continues to dominate SEA Limited’s story. The platform delivered solid revenue growth, especially in its core Southeast Asian markets. Logistics improvements and tighter cost management helped margins improve, giving investors confidence that Shopee is no longer a “growth at all costs” business.

But here’s the catch. E-commerce in Southeast Asia is a battleground. TikTok Shop is scaling aggressively, and Lazada, backed by Alibaba, refuses to give up market share. For Shopee, defending its lead could mean balancing profitability with the risk of losing buyers to more aggressive competitors.

2. The Quiet Rise of Monee

While everyone debated Shopee’s margins, Money quietly posted growth that deserves attention. SEA’s digital finance arm has been building its ecosystem (payments, lending, and financial services) that plug directly into Shopee’s e-commerce base.

This is where the curiosity comes in: if Shopee is the short-term growth driver, Monee could be the long-term differentiator. E-commerce competitors can slash prices to attract users, but not all of them can bundle payments, credit, and digital wallets at scale. SeaMoney gives SEA Limited an edge that could outlast a simple price war.

3. Garena Still Struggles

On the other side, Garena, SEA’s gaming division, continued to decline. Free Fire remains popular, but its momentum is a shadow of its peak years. For many investors, Garena is no longer the story. It’s now about whether Shopee and Monee together can carry SEA’s valuation and restore confidence in its long-term growth.

We covered this in more detail in our latest Wealth Pulse session. Watch the full breakdown here:

GoodWhale’s Take

The 2025 earnings confirm that SEA Limited is evolving. Shopee is still the star, but Monee is the subplot that investors should not ignore. If SeaMoney continues to expand in payments and lending, it could quietly transform SEA from a pure e-commerce play into a broader fintech powerhouse.

Most headlines will tell you “Shopee grew again.” But the real question investors should ask is: will Monee write the next chapter of SEA Limited’s story?

Stay updated with like-minded investors!

This is a segment of our wealth pulse session. Every Tuesday, SGT 8 pm, 2 parts. One part is for the public and you can find it in our YouTube Live. The second part is a closed-door session for our community members where we share more in-depth and personal portfolio.

Interested to find out more?

Here’s a 1-month free pass for you to experience or watch all our recordings!

Investing is a part of our money journey, so if you have no idea where to start, why not join to listen about what’s happening in the world!

Also, while you spend money on Shopee, start tracking your expenses too! This will give you a good idea of what you are spending on (hopefully not too much impulse buys!).

We have developed GoodWhale Buddy, you AI Companion to make expense tracking as easy as possible! Try it out on Whatsapp, Telegram, or Line and build wealth on your own terms!

Leave a Reply