Meta vs. Google. This is one of the most common searches for investors that is considering which of these giants is the best in the ad space. Read more to find out how they performed for their Q1 earnings.

Last week, the tech giants Meta and Google unveiled their Q1 2024 earnings, surprising investors and analysts alike. Both companies not only surpassed analysts’ expectations but also announced their first dividends, marking a significant shift in their financial strategy. Here’s a deeper dive into their earnings reports and what it means for investors.

Meta’s Bold Bet on AI: A Risk Worth Taking?

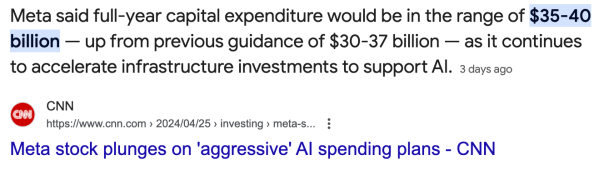

Meta’s recent earnings report highlighted its aggressive investment in AI technologies, particularly in developing their own large language models (LLMs). CEO Mark Zuckerberg pointed out that these investments are long-term and might not see immediate financial returns. This year, Meta is set to pour $35-40 billion into these initiatives, raising their expenditure from previous guidance.

Source: CNN

While this move has led to a sharp sell-off, reducing their market cap by $132.2 billion, it’s essential to understand the strategy behind this decision. Meta’s focus on AI is not just about staying competitive but also about setting the stage for future revenue streams that could redefine their business model.

Google: Striking the Right Balance Between Growth and Shareholder Value

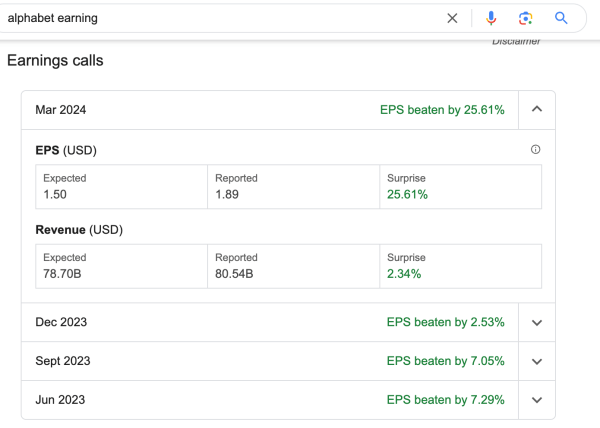

In contrast, Google’s parent company, Alphabet, reported a staggering revenue of $80.54 billion for the quarter, significantly above the $66.04 billion estimated by analysts. Their earnings per share (EPS) also saw a 25% increase over expectations, coming in at $1.89 compared to the forecasted $1.50.

Source: Google

What truly set Alphabet apart this quarter was their announcement of issuing dividends for the first time, signaling a robust cash flow and a shift towards enhancing shareholder value. This strategic move not only reassures investors about the company’s financial health but also reflects its ability to generate profit while investing in growth areas like AI and cloud computing.

Source: Financial Times

Meta VS Google: Market Reactions and Strategic Outlook

The market’s reaction to both companies’ earnings was markedly different. Google’s stock benefited from the positive earnings surprise and the dividend announcement, which likely attracted both growth and value investors. On the other hand, Meta faced a downturn, primarily due to investor concerns over the short-term impact of its heavy AI investment.

Looking ahead, Google seems to be positioned well to continue its growth trajectory with balanced investments in innovative technologies and shareholder returns. Meta, while currently facing market skepticism, is banking on its AI investments to pay off in the long run, potentially leading to substantial gains if these technologies capture new market segments and enhance their core business offerings.

Conclusion

As both companies navigate their strategic paths, investors should consider the long-term potential of Meta’s AI investments against the immediate returns and stability offered by Google. For those holding Meta shares, it might be wise to consider the long-term view, especially if the company’s core advertising revenue continues to hold strong. Conversely, Google presents a less risky proposition with its consistent performance.

The new dividend policies by Meta and Google marks a pivotal change to their financial strategy, traditionally focused on reinvesting profits back into growth and development. For investors, these dividend policies provide a fresh lens through which to evaluate the attractiveness of these tech giants as long-term investments. It demonstrates a maturation in their financial strategy, reflecting both companies’ evolution from high-growth startups to established leaders mindful of providing consistent shareholder returns.

In conclusion, while the tech landscape continues to evolve rapidly, the strategic decisions made today by companies like Meta and Google will likely define their trajectory for years to come. For investors, understanding these strategies and their implications is crucial in making informed decisions.

To read more articles, visit or GoodWhale Blog at GoodWhale.com

Leave a Reply