When someone hears the term “median salary in Singapore,” the first instinct is to compare. Am I earning more or less? Am I behind my peers?

Of course I’m curious too!

A recent article from DollarsAndSense breaks down the median salary in Singapore across age, gender, education, and race. It’s insightful, but let’s zoom out for a moment.

Do these numbers really reflect your career fulfillment… or financial health?

Income Is Only One Piece of the Puzzle

It’s natural to want more income. But career satisfaction isn’t just about the pay.

Think about it. Would you trade a slightly higher salary for a toxic work environment?

For most of us, the answer is no.

From my own experience, I’ve found that these factors matter even more than just salary:

-

Healthy relationships at work

Colleagues and managers play a huge role in your daily well-being. A toxic boss or politics-heavy culture can wear you down, fast. -

Work culture and benefits

Does your company respect your time? Do they care about employee growth? These shape how you feel every day at work.

Personally, I’d rather bring home a bit less each month but feel at ease with the people I work with and the mission I believe in. I’m not sure about you, but I’m going to spend 1/3 of my weekdays with these people. I rather work with people I like than people that I dislike.

Don’t Obsess Over Starting Salaries

For those of you just stepping into the working world, I get the pressure. You see peers posting their offers on LinkedIn, you hear stories of $5k starting pay. And you look at your own, feeling demoralized.

But the truth is: your first salary doesn’t define your career trajectory.

The early years are meant for exploration. Try different roles, discover your strengths, build relationships, and get exposed to various work environments.

For me, i have a science background from secondary school till my university days. However, it didn’t stop me from exploring outside of science and eventually enter the finance space as an educator and co-founded GoodWhale

Money will come, especially when you’ve found a path that excites you.

What matters more than a high starting pay is building solid habits and clarity on what you want out of your career and life.

High Income ≠ Financial Freedom

Let’s flip the conversation.

A six-figure salary might look impressive, but does it guarantee financial security?

Not really. Here’s why!

Unless you are very strict with your spendings, what a high salary often comes with high expenses. Private condos, frequent dining out, luxury holidays, and inflated lifestyles. That’s lifestyle inflation right there, and it can quietly wipe out your monthly savings if you’re not careful.

For me, raising two kids has taught me that financial preparedness beats financial display. It’s not about what people see. It’s about whether you can weather tough seasons or unexpected costs. My focus is to provide for my family, not to show off the number of trips I go to, but to ensure that financially we are well to do till our retirement, our kids’ education, and being present in their years growing up.

It’s often easy to spend for the sake of “giving the best to my kids”. But is that really the case

The Real Game-Changer? Tracking Your Expenses

Here’s a question I always ask: Do you know how much you spend every month?

If you don’t, you’re driving blind.

Knowing your income is good. But knowing your savings rate, that’s where financial confidence starts. The only way to get there? Track your expenses.

And it doesn’t need to be a painful Excel ritual.

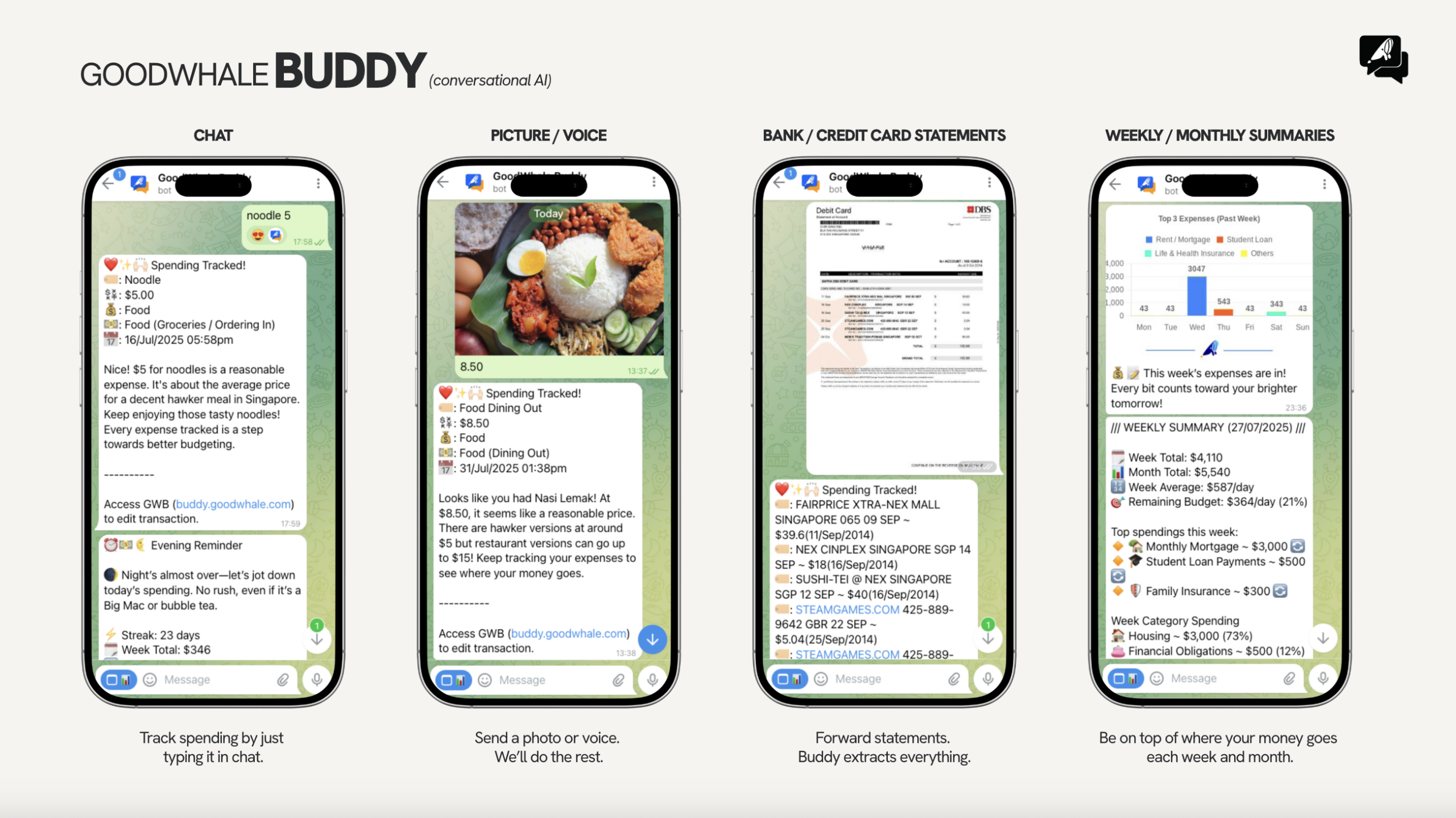

Meet GoodWhale Buddy! Your AI Expense Tracker

We built GoodWhale Buddy to make expense tracking as easy as texting a friend.

You can:

-

Text something like: Lunch 8.50. OR even local context, like Laksa 6.

-

Snap a photo of your receipt or food

-

Send a quick voice note

-

Upload your bank statement for automated logging

No need to manually key in every little thing.

To make you stay on track to building a new habit,

We believe financial freedom starts with awareness. Once you know where your money goes, you can redirect it to where it should grow.

Rainy Day Funds Start with Awareness

By the way…The Monetary Authority of Singapore (MAS) recommends a 3–6 month emergency fund.

But how do you know what 3–6 months’ worth of expenses is… if you don’t track them?

Whether you’re a fresh grad or a parent, having clarity over your expenses gives you peace of mind. It’s the first step in building a solid foundation — before investing, buying insurance, or planning for a home.

My $5:

The median salary in Singapore is useful, but it’s not the full story.

Instead of benchmarking yourself against others, focus on what you can control:

-

Your savings rate

-

Your spending patterns

-

Your money values

With tools like GoodWhale Buddy, we’re making that journey a lot easier.

Don’t let comparison steal your clarity.

Track your expenses today with GoodWhale Buddy, the easiest way to gain control over your money and start building real wealth, one habit at a time.

Leave a Reply