1. Set a Holiday Budget That Works with Your Credit Card

Start your holiday spending on the right foot by listing all expenses—gifts, travel, meals, and decorations. Set a realistic limit for each category based on what you can afford to pay off in full.

Use your credit card as a budgeting tool by assigning specific categories to it and tracking spending in real time via the card’s app. This keeps you accountable and helps avoid overspending.

Pro Tip: Leverage your credit card’s budgeting tools or spending trackers to stay on top of holiday finances.

2. Choose the Right Credit Card

Picking the right credit card can save you money and offer perks. Look for cards with cashback, travel rewards, or holiday shopping discounts. If carrying a balance is likely, opt for a low-interest card.

Additional benefits like extended warranties or purchase protection are especially helpful for big-ticket items. Take advantage of these features to maximize the value of your holiday spending.

Pro Tip: Check for seasonal promotions or bonus rewards with your card to make your holiday shopping more rewarding.

3. Avoid Minimum Payments

Paying only the minimum on your credit card can lead to long-term debt. Aim to pay off your balance in full each month to avoid costly interest charges.

If you can’t pay in full, prioritize high-interest balances to minimize overall costs. Plan your credit card usage around what you can afford to repay promptly.

Pro Tip: Allocate part of your holiday budget for credit card payments to avoid lingering bills after the season.

Read: 5 Easy Steps How to Pay Off Credit Card Debt

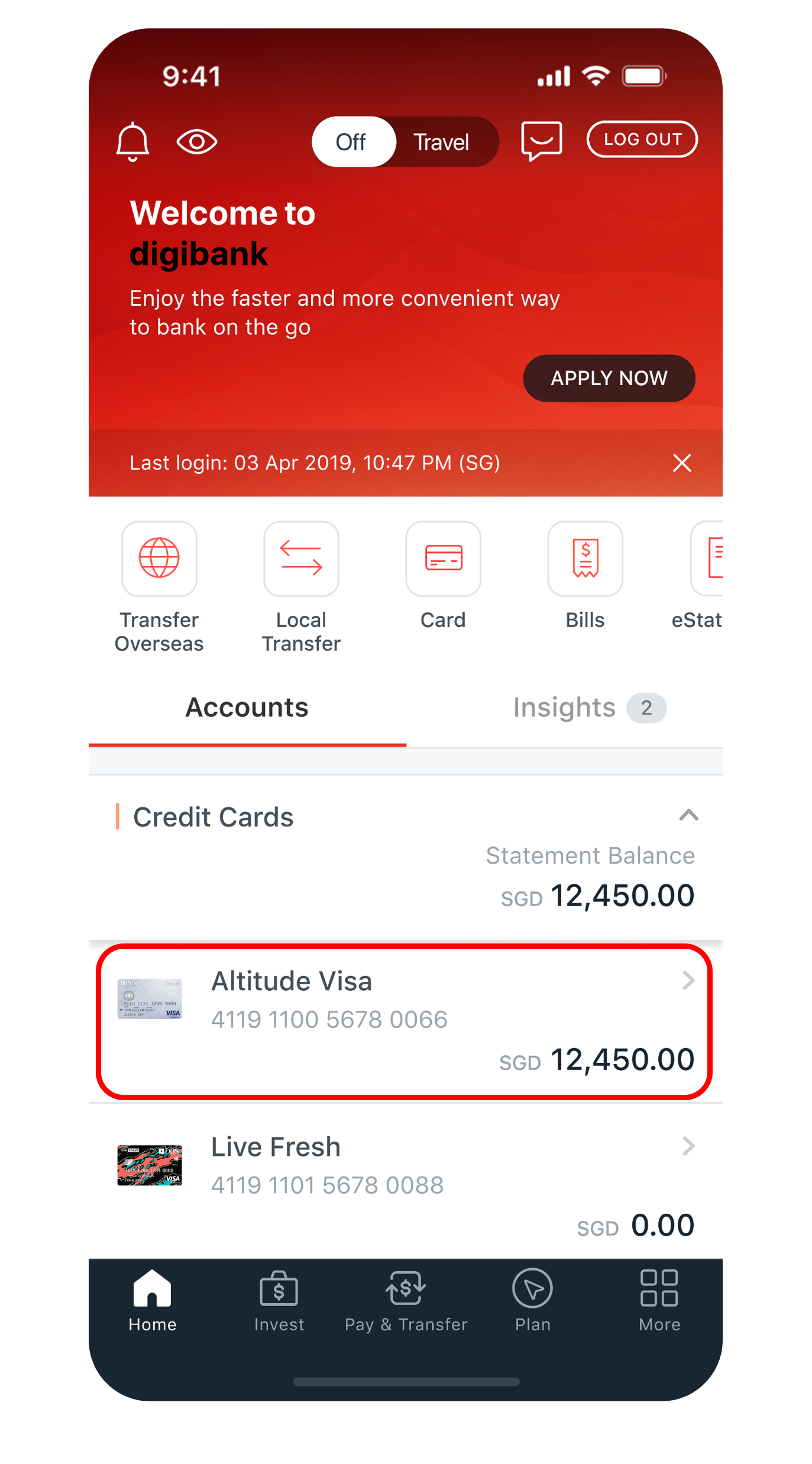

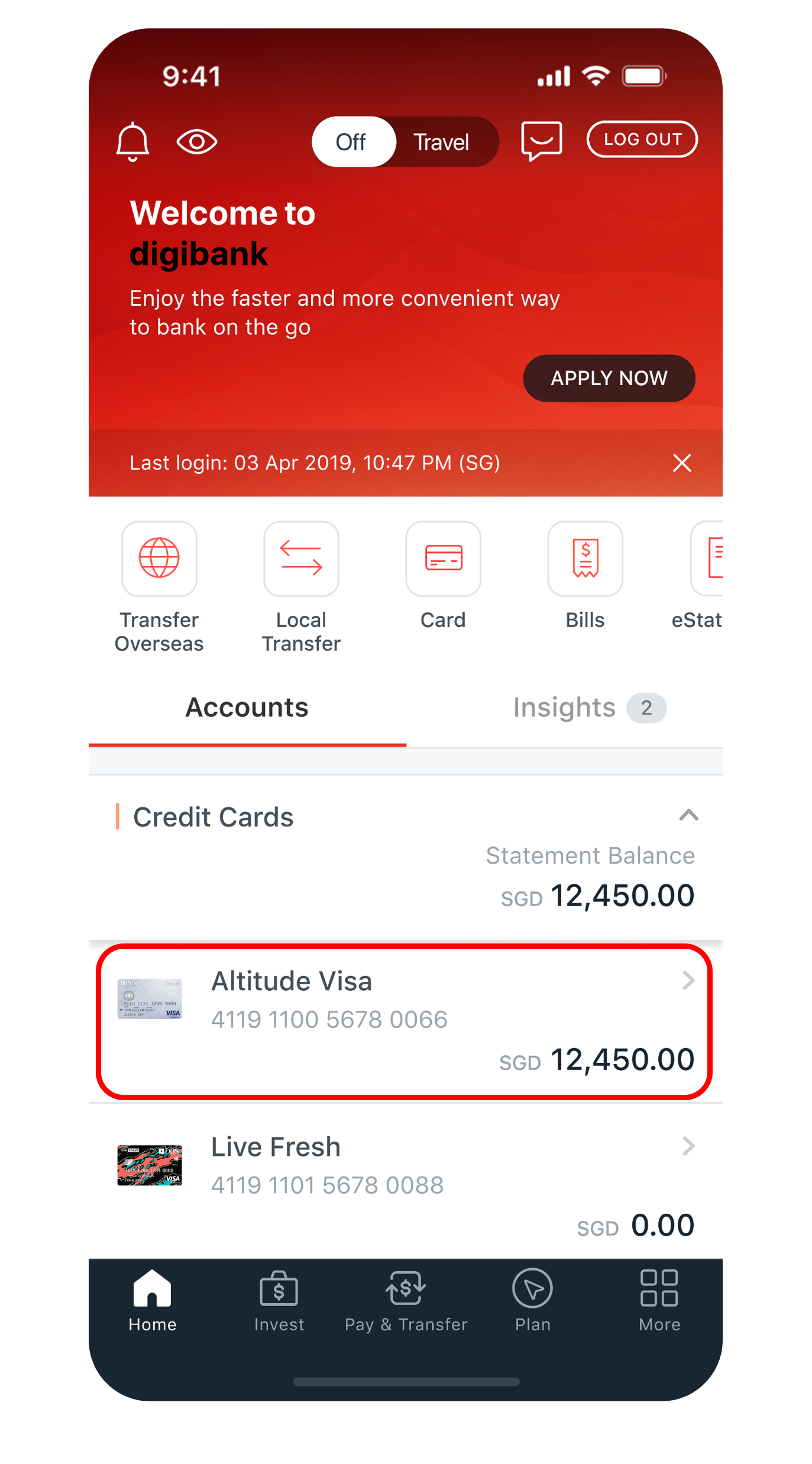

4. Track Purchases in Real-Time

Holiday shopping often leads to frequent transactions. Use your credit card’s app to monitor purchases in real time. This ensures you stick to your budget and catch unauthorized charges quickly.

Holiday shopping often leads to frequent transactions. Use your credit card’s app to monitor purchases in real time. This ensures you stick to your budget and catch unauthorized charges quickly.

Set alerts for large or unusual transactions to stay informed and avoid surprises. Real-time tracking keeps your finances under control amid the holiday hustle.

Pro Tip: Categorize purchases in your app to better understand your spending and pinpoint areas to cut back.

5. Say No to Impulse Purchases

Holiday deals are tempting, but impulsive buying can derail your budget. Before making a purchase, ask if it’s within your budget and aligned with your priorities.

Stick to a detailed gift list to avoid unnecessary spending. This ensures your purchases remain thoughtful and meaningful.

Pro Tip: Use your credit card’s wishlist feature to save items and revisit them later, giving you time to decide if they’re worth buying.

6. Use Rewards Wisely

Credit card rewards can ease holiday costs. Redeem points for gifts, cashback, or travel discounts. But don’t overspend to earn rewards—it defeats the purpose.

Maximize savings by combining rewards with seasonal sales or retailer-specific deals. This helps you stretch your budget without added expenses.

Pro Tip: Time purchases around your card’s reward structure to earn more for what you already plan to buy.

7. Limit Credit Card Use

Credit cards are convenient, but using them for every holiday purchase can lead to overspending. Use cash or debit for smaller expenses and reserve credit cards for larger, planned purchases.

Carrying fewer cards helps control spending. Keep one card in your wallet to reduce temptation and simplify tracking.

Pro Tip: Set a personal credit limit for holiday purchases, even if your card allows for more, to avoid overextending.

8. Plan for Post-Holiday Expenses

Prepare for post-holiday bills by planning ahead. Set aside funds to pay off purchases promptly, avoiding unnecessary stress or lingering debt.

Consider starting a “holiday sinking fund” to save throughout the year. This ensures you’re ready for next year’s festivities without relying on credit.

Pro Tip: Review this year’s holiday spending and note areas to improve. Use this insight to plan better and save more for next year.

Holiday shopping often leads to frequent transactions. Use your credit card’s app to monitor purchases in real time. This ensures you stick to your budget and catch unauthorized charges quickly.

Holiday shopping often leads to frequent transactions. Use your credit card’s app to monitor purchases in real time. This ensures you stick to your budget and catch unauthorized charges quickly.