Teaching Financial Literacy to Kids: Empowering the Next Generation

As a parent, you want the best for your children. You strive to provide them with the tools and knowledge they need to succeed in life. One crucial area often overlooked is financial literacy. Many parents, especially those with experience in financial constraints, understand the stress and anxiety that come with managing money. Teaching financial literacy to your kids can break the cycle of financial instability and empower them to make smart financial decisions in the future.

The Pain of Financial Constraints

For parents who have experienced financial constraints, the struggle is all too familiar. The constant worry about making ends meet, the sacrifices made to ensure the family’s needs are met, and the fear of unexpected expenses can take a toll on your mental and emotional well-being. You don’t want your children to face the same challenges. By instilling financial literacy early on, you can equip them with the skills they need to avoid these hardships and build a more secure future.

Why Financial Literacy Matters

Financial literacy is more than just knowing how to balance a checkbook. It encompasses understanding the value of money, making informed spending decisions, budgeting, saving, and investing. When children learn these concepts early, they develop a healthy relationship with money that can benefit them throughout their lives. Here’s why it’s crucial:

- Avoiding Debt: Children who understand the dangers of debt are less likely to fall into the trap of credit card misuse or excessive borrowing.

- Building Savings: Learning the importance of saving helps children prepare for emergencies and future needs.

- Making Informed Decisions: Financial literacy empowers children to make informed choices about their purchases, investments, and lifestyle.

- Reducing Stress: A solid financial foundation reduces the stress associated with money management.

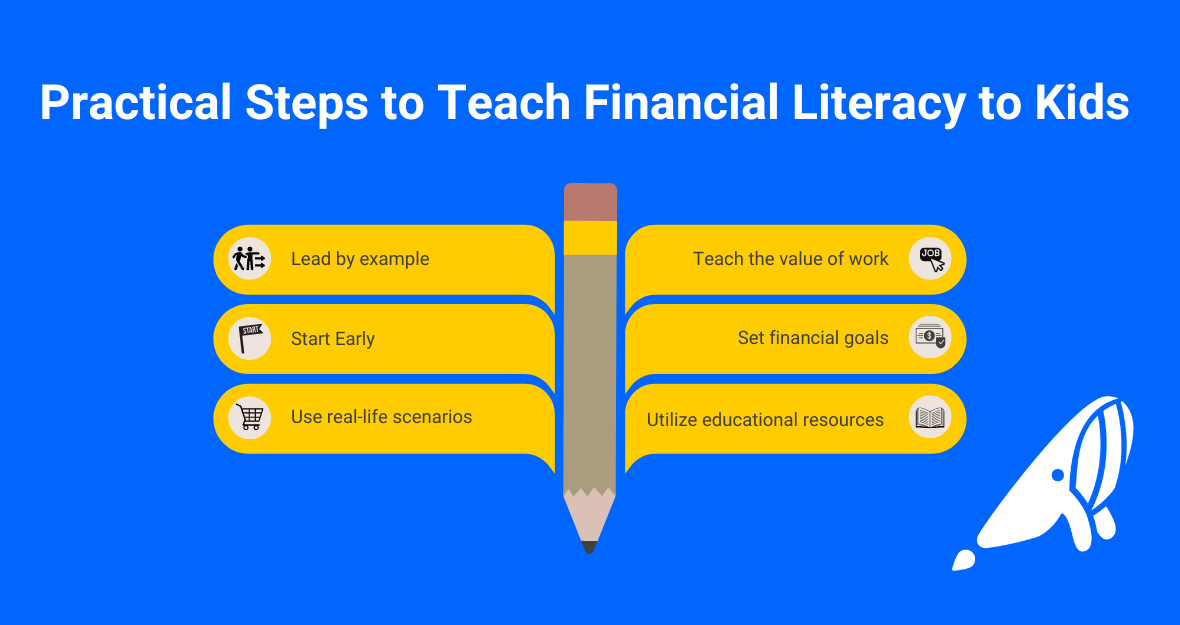

Practical Steps to Teach Financial Literacy

- Lead by Example: Children learn by observing. Show them how you manage money, make budgeting decisions, and save for future goals. Discuss your financial decisions and explain why you make certain choices.

- Start Early: Introduce basic concepts like saving and spending at a young age. Use everyday situations to teach lessons about money. For example, give them a small allowance and encourage them to save a portion of it.

- Use Real-Life Scenarios: Involve your children in financial discussions. Take them grocery shopping, show them how to compare prices, and discuss the importance of sticking to a budget.

- Teach the Value of Work: Encourage your children to earn money through chores, part-time jobs, or entrepreneurial endeavors. This helps them understand the value of hard work and the effort required to earn money.

- Set Financial Goals: Help your children set short-term and long-term financial goals. Whether it’s saving for a toy or a college fund, having a goal in mind can motivate them to manage their money wisely.

- Utilize Educational Resources: There are numerous books, apps, and games designed to teach kids about money. Use these resources to make learning about finances fun and engaging.

Three Steps to Guide Kids to Be Smart Spenders

Recently, I watched an insightful Instagram video by ms.tiffany.finlit that offered three effective steps to help kids become smart spenders:

- Set a Budget and Make a List: Before shopping, sit down with your child and set a budget. Help them make a list of items they need to buy within that budget. This teaches them to prioritize and stick to financial limits.

- Show and Explain Price Differences: While shopping, take the opportunity to show your child the price differences between similar items. Explain why one product might cost more than another and discuss value versus cost. This helps them make informed decisions.

- Celebrate Their Learning: After the shopping trip, celebrate your child’s success in sticking to their budget and making smart choices. Acknowledge their efforts and reinforce the positive behaviors they demonstrated. This encouragement builds confidence in their ability to manage money wisely.

These steps are simple yet powerful in shaping how kids approach spending and managing money. Incorporating them into daily life can make a significant difference in your child’s financial habits.

Overcoming Challenges

Teaching financial literacy can be challenging, especially if you’re not confident in your own financial knowledge. However, it’s important to remember that you don’t have to be an expert to teach your children. Start with the basics and learn together. Seek out resources and don’t be afraid to ask for help from financial advisors or educators.

Conclusion

Teaching financial literacy to children is an investment in their future and our society’s economic health. By equipping kids with essential money management skills, we’re empowering them to make informed decisions that can lead to lifelong financial stability and success.

Financial literacy fosters independence, critical thinking, and responsibility. As we guide children through budgeting, saving, and smart spending, we’re nurturing skills that will serve them in all aspects of life.

Starting financial education early creates a solid foundation for children to build upon. Whether through everyday teachable moments or structured lessons, every effort to increase a child’s financial knowledge contributes to their future well-being.

By prioritizing financial literacy for the younger generation, we’re paving the way for a society of confident individuals who can navigate the complexities of the modern financial world. Let’s commit to this important task and help create a future where economic opportunities are maximized for all.

Take the next step in your financial literacy journey. Join the GoodWhale Community today and be part of a movement that’s shaping a financially savvy future for our children. Connect with like-minded individuals, access free resources, and stay updated on the latest financial strategies.

Remember, it’s never too early to start teaching financial literacy. Begin today, and watch as the seeds of financial wisdom grow into a lifetime of financial freedom for the next generation.

[…] Read: Financial Literacy for Future Generations […]