Emergency Fund: How Much You Need and Where to Keep It

An emergency fund is your financial safety net when life throws you a curveball. Whether it’s a sudden job loss, medical bill, or car repair, having savings set aside can make all the difference. I learned this the hard way when my dad lost his job at a major airline due to unexpected management changes.

We thought his job was secure, but one day he came home with the news that he’d been let go. Just like that, everything changed.At first, we thought we’d be okay, but it didn’t take long to realize how unprepared we were. The bills kept coming, and the safety we took for granted was gone. That experience showed me that an emergency fund isn’t just a smart financial move—it’s essential. Here’s how you can avoid that stress by building one of your own.

How Much Should You Save in an Emergency Fund?

The amount you should save depends on your personal situation. Most financial experts recommend covering three to six months of essential living expenses. Here’s a breakdown to help you decide:

1. Three Months’ Expenses

If you have a stable, dual-income household, three months of expenses may be enough. One income can help sustain the household if the other is lost, giving you time to recover.

2. Six Months’ Expenses

For single-income families or those with less predictable income, six months’ worth of expenses is ideal. This provides extra breathing room if your income stops unexpectedly.

3. More Than Six Months

If you have dependents, health concerns, or work in a volatile industry, consider saving more than six months of expenses. It’s better to be over-prepared than under-prepared.

To calculate your target, add up your essential monthly expenses: rent/mortgage, utilities, groceries, insurance, and minimum debt payments. Multiply that by how many months you want to cover.

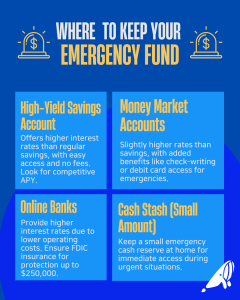

Where Should You Keep Your Emergency Fund?

Your emergency fund should be accessible, safe, and separate from your everyday spending. Here are a few smart places to keep it:

1. High-Yield Savings Account

These accounts offer better interest rates than regular savings accounts while keeping your money accessible. Look for one with no fees and a competitive annual percentage yield (APY).

2. Money Market Accounts

Money market accounts often offer slightly higher rates than savings accounts and may provide check-writing or debit card access for emergencies.

3. Online Banks

Online banks usually have higher interest rates because they have lower operating costs. Ensure the bank is SDIC-insured for protection up to $100,000.

4. Cash Stash (Small Amount)

Keep a small amount of cash in a safe place at home. This ensures immediate access in case of emergencies like a power outage or urgent repairs.

Why an Emergency Fund Matters

An emergency fund is your financial cushion during life’s unexpected events, such as job loss, medical emergencies, or urgent repairs. It gives you peace of mind and financial security, preventing you from falling into debt when life surprises you.

Starting small is perfectly fine—$500 is a great starting point. Gradually work towards covering one month of essential expenses and continue building from there. The goal is not just financial protection, but the confidence to face challenges without panic.

As you focus on building your emergency fund, it’s equally important to keep learning about financial literacy. Joining the GoodWhale community can provide you with valuable knowledge on budgeting, managing money, and making informed decisions.

By participating in discussions and learning from others, you’ll gain practical insights into life investing and strengthen your ability to handle your finances for the long run. Build your emergency fund, improve your financial knowledge, and become part of a supportive community that helps you grow your financial security.

[…] Read: Emergency Fund: How much you need and where to keep it […]