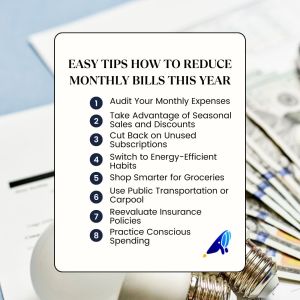

Start Saving Now: Easy Tips How to Reduce Monthly Bills This Year

1. Audit Your Monthly Expenses

The first step to reducing monthly bills is knowing where your money goes. Review your bank statements and categorize your spending. Focus on areas where costs tend to add up—like dining out, subscriptions, or utility bills.

Our family used to spend quite a bit on eating out, thinking it was just a small treat here and there. But when we started tracking our spending, we were surprised to see how quickly those meals added up. We decided to cut back by preparing more meals at home and limiting restaurant visits to once a week.

Pro Tip:

Use budgeting apps to automate expense tracking and identify patterns. This helps you pinpoint where adjustments are needed.

2. Take Advantage of Seasonal Sales and Discounts

A smart way to reduce monthly bills is by making your purchases during seasonal sales or taking advantage of special discounts. Whether it’s for clothing, household items, or even larger purchases like appliances, buying at the right time can help you save significantly. Many retailers offer discounts during off-peak seasons or around major holidays. You can also sign up for newsletters or follow your favorite stores to catch exclusive offers.

How to Start:

- Create a list of items you’ll need in the upcoming months.

- Plan to buy during sales events such as Black Friday, end-of-season sales, or clearance events.

- Set a budget for each purchase to avoid overspending even when there are discounts.

This strategy allows you to buy necessary items at a reduced price, freeing up money for other monthly expenses.

3. Cut Back on Unused Subscriptions

Subscription services, though convenient, can quickly add up and drain your wallet without you realizing it. It’s important to assess whether you’re really using all the subscriptions you’re paying for each month. From streaming services to fitness apps or even food delivery subscriptions, we often sign up for services that we don’t fully use. Take a close look at your bank statements and list out every subscription. If you find ones that you haven’t used in the last month or two, it might be time to cancel or pause them.

We had a few streaming services that we subscribed to for the sake of having options, but after reviewing, we realized we only watched one of them consistently. We decided to cancel two of the subscriptions and save over $30 a month.

Quick Tip:

Set reminders to reassess your subscriptions every three months.

4. Switch to Energy-Efficient Habits

Utility bills often take a large chunk of monthly expenses, but simple changes can lead to significant savings over time. Switching to energy-efficient LED bulbs, which use 75% less energy than traditional bulbs, can reduce your electricity bill. Unplugging unused electronics or using smart power strips to cut off power when devices aren’t in use helps eliminate “phantom” energy costs. Adjusting your thermostat by just a few degrees can save up to 10% annually on heating and cooling.

Consider These Investments:

- Energy-efficient appliances: They may cost more upfront but save money in the long run.

- Smart thermostats: These adjust temperature automatically based on your schedule.

- Window coverings: Insulating curtains help maintain a stable home temperature.

Small steps like these can significantly reduce utility bills while promoting a more sustainable lifestyle.

5. Shop Smarter for Groceries

Food costs can add up quickly, but planning meals, sticking to shopping lists, and avoiding impulse buys can help reduce overspending. Buying in bulk for non-perishables, like rice, pasta, or canned goods, often provides better value than buying smaller quantities. Generic brands are also a great way to save, as they offer similar quality at a lower price.

I used to think buying items per piece was cheaper, but I found that buying in bulk—like a large bag of rice—actually cost less per unit and lasted longer. This simple switch saved us a lot on groceries.

Money-Saving Ideas:

- Shop sales and use coupons.

- Buy in bulk for non-perishables.

These small changes can lead to big savings over time.

6. Use Public Transportation or Carpool

If you commute regularly, switching to public transportation or organizing a carpool can significantly reduce fuel, parking, and vehicle maintenance costs. Not only will this save you money, but it can also help lower wear and tear on your car, leading to fewer maintenance expenses over time. Plus, carpooling gives you the opportunity to share costs and reduce the stress of driving alone.

Bonus Benefit:

You’ll also be reducing your carbon footprint, contributing to a cleaner environment while saving money—double the impact!

7. Reevaluate Insurance Policies

It’s important to periodically review your auto, health, and home insurance policies to ensure you’re getting the best value. Shopping around for better rates or comparing different providers can reveal more affordable options. Additionally, ask your current insurer about discounts for bundling multiple policies, such as home and auto insurance, which can often save you a significant amount each year.

Taking the time to reassess your coverage helps you avoid paying for unnecessary extras while ensuring you’re still adequately covered.

8. Practice Conscious Spending

Avoid emotional spending by pausing and evaluating whether a purchase truly aligns with your long-term financial goals. It’s easy to get caught up in the moment, especially when you’re feeling stressed or tired, but making impulsive buys can derail your budget. Focus on prioritizing needs over wants, and create a monthly “fun fund”—a set amount of money allocated for guilt-free treats or small splurges. This way, you can enjoy occasional indulgences without compromising your financial stability. By being intentional with your spending, you’re making conscious choices that align with your future goals.

Read: How to Stop Impulse Buying and Take Control of Spending

Conclusion

Reducing monthly bills starts with small, intentional changes. From auditing your expenses to negotiating better deals, these steps can help you take control of your budget and work toward financial stability. For first-time investors or anyone striving to save more, these habits can make a big difference over time.

Start implementing these tips today and see the impact they can have on your finances. Ready to take the next step in your financial journey? Join the GoodWhale Community to learn more and connect with others on the same path!

Leave a Reply