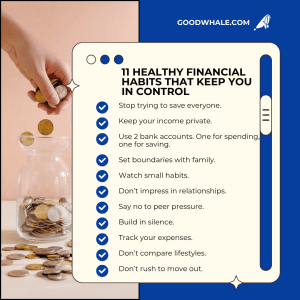

11 Healthy Financial Habits That Can Save You From Going Broke Again

Reaching a point of financial stability isn’t easy, especially if you’ve hit rock bottom before. It takes months, even years, of sacrifice, discipline, and delayed gratification. But staying financially stable? That’s another battle altogether. And if you’re not careful, one wrong turn can undo everything you worked so hard for. That’s why developing healthy financial habits is non-negotiable.

Many people don’t realize it, but money problems often start with the small, everyday choices. A little lending here, an unplanned dinner there, it adds up. Before you know it, your savings are gone, and you’re wondering where your money went.

Here are 11 powerful habits to help you protect your progress and avoid falling back into financial chaos:

1. You’re not everyone’s emergency fund.

It’s natural to want to help others, especially when their stories feel urgent or emotional. But if you’re always stepping in to “save” people, you’ll burn out financially and emotionally.

Example: You gave your friend 35$ for rent last month, and now your electricity bill is overdue. Learn to say no without guilt. You’re not being heartless, you’re being wise.

2. Keep your salary to yourself.

Telling people how much you earn, even family, can lead to unrealistic expectations.

One day you say you got a raise, the next thing you know, a sibling is hinting about tuition or a new phone. Keep your income private so you can plan freely without pressure.

3. Use two accounts: one for spending, one for saving.

Discipline becomes easier when your money has structure. Try this: Every payday, transfer your savings first, then budget the rest.

If your spending account hits zero by the 25th of the month, that’s it. Don’t touch the savings, no matter what story comes your way.

4. Don’t carry your family’s burden alone.

Helping is good, but sacrificing your financial health isn’t.

You’re not selfish for saying, “I can’t right now.” If your finances collapse, the same people might still question your spending. Set healthy boundaries.

5. Watch out for silent money-drainers.

Some habits feel harmless like ordering milk tea every day or joining online raffles. But over time, they eat up your budget.

If you’re spending 4$ daily on random cravings, that’s 120$ a month gone on impulse alone. Be honest with yourself about your habits.

6. Stay focused in relationships.

Avoid romantic entanglements that pressure you to constantly impress or spend.

If you’re dating someone who expects big gifts or weekly dine-outs, ask yourself: is this helping or hurting my goals? A relationship should support your growth, not drain your wallet.

7. Say no to peer pressure spending.

Not all friend group outings are worth attending especially when it means spending money you don’t have.

Some friends might suggest, “It’s just 20$,” not knowing that’s your grocery money. Learn to say, “Next time,” and stick to it.

8. Build in silence.

You don’t need designer bags or flashy shoes to prove you’re doing well. The more you flaunt, the more you attract pressure and judgment.

Save for your first investment quietly. Let your growth speak for itself.

9. Always track your spending.

Swiping your card or using e-wallets makes it easy to overspend.

You think you only spent 100$ this week, but your bank app says otherwise. Make it a habit to review your expenses weekly. Awareness is power.

10. Don’t compete with people in a different lane.

Some people don’t pay rent. Others still get full support from parents. Don’t compare your lifestyle to theirs.

You might be working two jobs while they’re living comfortably without bills. Focus on your own journey.

11. Don’t move out too early if you’re not ready.

Living on your own sounds great, until you see the bills. If your parents’ house is peaceful and you’re allowed to stay, take advantage of the time to build your emergency fund or save for a business.

Outside life is real—rent, utilities, food, transportation, it piles up fast.

Final Thought:

Financial stability isn’t just about earning more, it’s about managing what you already have, consistently and wisely. It means being intentional with your spending, disciplined with your saving, and courageous enough to say “no” when necessary. The truth is, money won’t manage itself. And without structure, even a high income can slip through your fingers.

Yes, some of these healthy financial habits might feel uncomfortable or even inconvenient at first. But over time, they create the safety net and freedom you’ve been striving for. You’ve already done the hard part—getting back on your feet. Now protect that progress by building smarter routines, drawing boundaries, and staying grounded even when life (or people) try to pull you off track.

And if you need help making those habits stick, GoodWhale Buddy can guide you. Whether you’re just starting your financial journey or trying to rebuild, this smart AI companion is ready to walk with you every step of the way. From tracking your daily expenses, managing your monthly income, to setting long-term goals—GoodWhale Buddy makes it easier to build the life you’re working toward.

✅ Available on Telegram, WhatsApp, and LINE, it works right from your preferred messaging app, no need to download anything new.

✅ Whether you’re saving for a trip, paying down debt, or growing your money for retirement, GoodWhale Buddy offers personalized tools and real-time guidance to help you stay in control.

Start developing your healthy financial habits today. Let GoodWhale Buddy help you stay on track for good.

Best Sad Shayari Great information shared.. really enjoyed reading this post thank you author for sharing this post .. appreciated