May 5, 2024

Berkshire Hathaway AGM 2024 remains a pivotal event for investors globally. This year, however, will probably be the weirdest gathering of value investors and shareholders alike.

The first BRK AGM 2024 without the sightings of the Late Charlie Munger munching on See’s Candies. Read here to learn from Charlie Munger’s wisdom now!

Source: X

Approximately 70,000 to 80,000 people globally gathered at CHI Health Center, Omaha, US, where the BRK annual meeting is hosted.

In the digital space, like-minded people tuned in to the live broadcast from CNBC with over 217,000 views. It may not be like the biggest sensational hits or content that are trending. But, the people who viewed this 7-hour long video have one thing in common…

Hearing the wisdom from Buffett and the team, both on business, investing and life!

Source: Youtube (CNBC)

Despite the passing of the legend, Charlie Munger was brought up multiple times by Warren Buffett, reminiscing the times with Charlie. He even mistaken Greg Abel as Charlie.

More importantly, through the Q&A from the audience and curated questions by Becky Quick, many questions about their business, investing and life was shared by Warren Buffett and his team.

Here’s my 5 biggest takeaways from Berkshire Hathaway AGM 2024!

4 biggest takeaways from Berkshire Hathaway AGM 2024

1. Don’t check the price too often

In the first part of the AGM, Warren Buffett was comparing the returns of people who were short-term and long-term shareholders.

Those people who “forgot to check the price” tend to make better returns, which reinforces that long-term investing in a sound business is the true returns generator.

When one checks the price constantly, the focus will no longer be about business. When that happens, you may have a high long-term opportunity cost.

2. Key Man Risks: Succession

In business, key man risk is a concern. Key man risk is where an individual or a group of employees are the core pillars of the business. If they were to leave or go on a strike, the business would be impacted greatly.

The fantastic performance of Berkshire Hathaway has always been pointed towards the leadership of the late Charlie Munger and Warren Buffett. Both leaders had been mentioning about succession to the next leaders for years now.

Greg Abel and Ajit Jain are the top brass, dealing with non-insurance and the insurance business respectively. While succession from Warren Buffett and Charlie Munger has been in place, a brief conversation about reducing key man risk from Greg and Ajit was also mentioned. “In the situation, I was hit by a truck” – Ajit Jain.

With the new leader, Greg Abel will be in charge of capital allocation and managing investments. People will be interested how is he going to allocate and manage, which may put Berkshire on a different trajectory.

Key man risks apply not only to businesses but our personal lives too! As a provider of monetary support, parents are often key man risks too! That is why having your protection in terms of insurance, legacy and estate planning, and finding alternative sources of income is important too.

3. Reduced Apple Position is more for Tax reasons, not a fundamental shift

When Berkshire Hathaway reportedly sold 115 million Apple shares, the market reacted.

Many wondered if the company decided to exit the Apple business. Yet, Berkshire’s Apple stake ended the first quarter with 790 million shares. That’s still a lot of shares!

Apple’s contribution to the company’s investment portfolio is still huge. This was reinforced by Buffett that it was mainly due to tax reasons. It may be to avoid the future where a higher tax bill may be implemented to deal with the increasing U.S. fiscal deficit.

4. Don’t get greedy with money

When it comes to making money, the insurance arm is a profitable one when managed right.

One question posed to the vice chairman of insurance operations, Ajit Jain, was on cyber insurance. Cybersecurity has been the priority to many organization, especially with the increasing value of the data collected to generate insights and revenue generation.

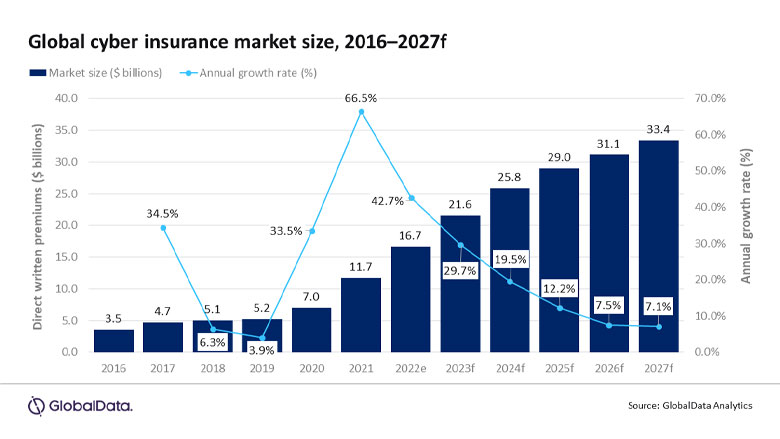

That said, people still want to be assured in case of cyber attacks. That’s where insurance comes in to underwrite cyber insurance. According to Jain, cyber insurance is profitable and amounts to about 20% of total premiums.

This is why the market size of cyber insurance has been forecasted to increase now that AI and machine learning comes to the picture.

Source: Global Data Analytics

Although the money coming in may be attractive, Jain shared that this business may be loss making in the long run. He shared that when cyber attacks are held, it can amount to a huge loss, not to mention that multiple attacks may be conducted concurrently, making the losses increase exponentially.

Insurance is all about risk management. Not knowing the worst case is what scares Jain the most. Quoting Jain, he discouraged staff from writing cyber insurance. “Each time you write a cyber insurance policy, you are losing money.”

This is especially true in our real life. There are many ways to make money. We have to find the one that fits our value and also something we are comfortable with. If were to be greedy and chase the money in the short-term, there may be a long-term backlash which may either harm your reputation and your relationship with the people around you.

Conclusion for Berkshire Hathaway AGM 2024

Berkshire Hathaway AGM 2024 is full of insights to investors and fellow advocates of long-term investors.

While this is the first year without the legend, Charlie Munger, his experience and knowledge has been conveyed by Warren Buffett from the times the two leaders of Berkshire Hathaway has journeyed together.

From the AGM, I have written 4 biggest takeaways I’ve received. Do read and also share with me what are yours!

For more intriguing articles, visit GoodWhale.com

If you want to stay updated with the key market news, subscribe to Wealth Pulse for weekly updates!